What the Recent Decisions in D.C. Mean for Delaware’s Children, Families, and Educators

As of July 28, 2025

The recently enacted federal reconciliation package, HR 1 One Big Beautiful Bill Act, was signed into law on July 4. It comes alongside a series of actions by the Trump Administration, including executive orders, agency rule changes, and non-regulatory guidance limiting eligibility for key programs. Together, these measures undercut support for children, families, and educators across the country, with minor advancements in workforce funding and tax policy for families with young children. For Delaware, this means losses in funding for schools, child care, food assistance, health coverage, and many more programs. These decisions are coupled with a recent Supreme Court decision to allow for the firing of 1,378 U.S. Department of Education staff, or about a third of the agency—and efforts are underway to move existing functions, like Career and Technical Education into other agencies.

Together, these measures signal a sea change in the relationship between the federal government and our schools. As I shared in April, while the U.S. Department of Education was officially established about 46 years ago (1979), there were growing efforts in the decades prior to increase educational access to students of color, low-income students, and those with disabilities. This collection of shifts in the last six months will undercut many of these supports for children and families and shift much of the cost for these supports back to states for years to come.

Yes, there were modest advancements in workforce funding and tax policy for families with young children, but for Delaware, the reductions in funding and in the number of people to ensure the funds are spent appropriately, this largely means reductions in funding and services for schools and colleges, child care, food assistance, and health coverage.

Importantly, HR 1, which by itself surpasses 900 pages, is separate from the still-pending Fiscal Year (FY) 2026 appropriations process, as well as the Administration’s recent action to withhold FY 2025 funding that supports afterschool programs, summer learning, and a range of K-12 and adult education programs. Future appropriations and withholding existing federal funds further compound the uncertainty for Delaware, especially because many provisions, including those in HR 1, have staggered or unclear effective dates, adding to the complexity for state leaders and communities.

This is a lot to take in, but we’ve tried to organize this so that Delawareans can better understand the implications of these decisions by category and begin to identify a path forward.

K–12 Education Funds on Hold

$26.6 million in federal education funds is being withheld from Delaware students and families

Update as of July 28, 2025: Shortly after this post was published, the Trump Administration reversed course and released the $6.8 billion in withheld federal education funds, including $26.6 million for Delaware. While this is a welcome shift, it does not reverse other cuts and programmatic changes outlined below. Read more from Education Week.

Effective ImmediatelyOn July 1, the Delaware Department of Education (DDOE) was expecting to receive federal grant funds, which had previously been appropriated by Congress and signed into law by the president, to deliver a range of educational services and to support state implementation. As is true with many federal education programs, these funds are used to directly support vulnerable student groups, such as multilingual learners, and to support programs that serve youth outside of schools and their families.

Instead, the U.S. Department of Education notified states late in the day on June 30, that it was impounding funds from five key programs. The total amount of federal funds held back nationally across these programs is $6.2 billion, or an even greater sum of $6.8 billion when you include the funds intended for adult learners under a different grant. The federal programs affected are:

- Teacher training & professional development (authorized under Title II, Part A of ESEA, 20 U.S.C. § 6611 et seq.)

- English Learner support (authorized under Title III, Part A of ESEA, 20 U.S.C. § 6811 et seq.)

- Student Support and Academic Enrichment (authorized under Title IV, Part A of ESEA, 20 U.S.C. § 7111 et seq.)

- 21st Century Community Learning Centers (authorized under Title IV, Part B of ESEA, 20 U.S.C. § 7171 et seq.)

- Adult Education State Grants (authorized under Title II of the Workforce Innovation and Opportunity Act, 29 U.S.C. § 3271 et seq.)

- Migrant Education (authorized under Title I, Part C of the Elementary and Secondary Education Act, 20 U.S.C. § 6391 et seq.

Because the decision to withhold these dollars came at such a late date, Delaware lead education agencies had already budgeted these funds for FY2026, leaving uncertainty as the federal Department of Education delays dispersing them.

Read a statement from the Delaware Secretary of Education Cindy Marten.Early Childhood Programs like Head Start under Threat While Tax Credits Expanded

While HR 1 doesn’t directly cut Head Start, it caps domestic spending and shrinks the overall budget for programs like it.

Combined with ongoing efforts from the Trump Administration, including delayed payments and regional office closures, portions of the bill deprioritize early childhood education.

At the same time, the Child and Dependent Care Tax Credit (CDCTC) has been expanded, boosting direct tax relief for families paying for child care, particularly those earning under $150,000. For Delaware families, this means a $900 increase in average annual benefits.

Effective 2026The legislation enhances other tax credits as well, including:

- The Employer-Provided Child Care Credit (Section 45F), which makes it easier for Delaware businesses—especially small and mid-sized employers—to support employees through on-site care, partnerships with providers, or subsidy programs.

- The Dependent Care Assistance Plan (DCAP), which is a flexible spending account that allows families to set aside pre-tax income to pay for child care expenses.

The changes to these tax credits (CDCTC, 45F, and DCAP) have received overwhelming bipartisan support.

Individuals with Disabilities Education Act (IDEA) Underfunded

HR 1 worsens existing underfunding of IDEA, leaving a $38.7 billion gap nationally and further straining schools’ ability to serve students with disabilities.

The reconciliation bill also cuts Medicaid, which is a critical support for many disabled students. Medicaid helps fund essential services for students with disabilities, including speech therapy and behavioral and mental health counseling, by reimbursing schools for the costs tied to services documented in a student’s individualized education plan (IEP).

It also expands school voucher programs through the Education Choice for Children Act (ECCA), which diverts funds from public schools and, when utilized by students with disabilities, results in a loss of the full protection of IDEA.

Effective January 1, 2026The legislation further creates a new $1,700 tax credit for “qualified elementary and secondary education scholarships,” which can be used for expenses tied to public, private, or religious schooling. This is concerning in that it blurs the constitutional lines between church and state and further shifts public dollars away from serving the 90 percent of students in Delaware’s public schools.

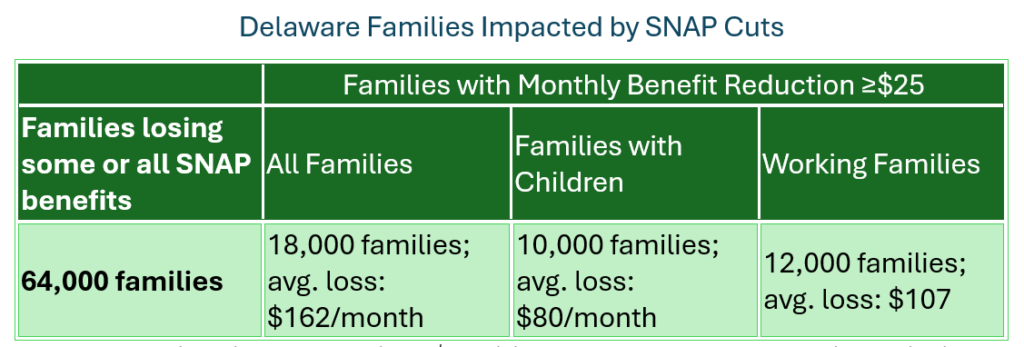

Read Rodel’s statement on vouchers here.SNAP (Supplemental Nutrition Assistance Program) Cuts to Impact 64,000 Families in Delaware

Effective FY 2027–2028HR 1 freezes future SNAP benefit increases by preventing updates to the Thrifty Food Plan (TFP), which sets benefit levels. This would lock benefits at already outdated levels.

The bill also expands work requirements to include adults up to age 64 (up from age 60) and adds parents of children under 14, while removing exemptions for veterans, unhoused people, and former foster youth. It further restricts states’ ability to waive work requirements (only allowed if local unemployment exceeds 10 percent). Rather than supporting employment, this change has been shown to take away health coverage from workers in states like Arkansas and Georgia.

The legislation further cuts access for legally present immigrants and bars all non–lawful permanent residents from SNAP—including refugees and asylees. This decision will directly impact citizen children in mixed-status families. Similar announcements for programs like Head Start and Temporary Assistance for Needy Families (TANF) have left these children and their families in an impossible situation.

Finally, HR 1 imposes a new state funding match, requiring states for the first time to contribute toward SNAP benefits—starting in FY 2028. The federal cost-share would drop from 100 percent to 75 percent, with each state’s required match tied to its SNAP payment “error rate,” tabulated whenever a state issues more or less in SNAP benefits than a household is eligible to receive.

Errors often result from outdated or incorrect income information, delays in processing household changes (like jobs or living arrangements), or mistakes made by caseworkers during eligibility reviews. They do not typically reflect fraud. Delaware’s current error rate of 12.37 percent (FY 2024) places it in the highest penalty bracket, meaning the state will be responsible for $15 million of total SNAP costs.

Note: Delaware is projected to contribute $15 million annually toward SNAP benefits starting in FY2028 due to changes in the state match. This does not capture total family benefit losses, which will vary based on future program participation and economic conditions.

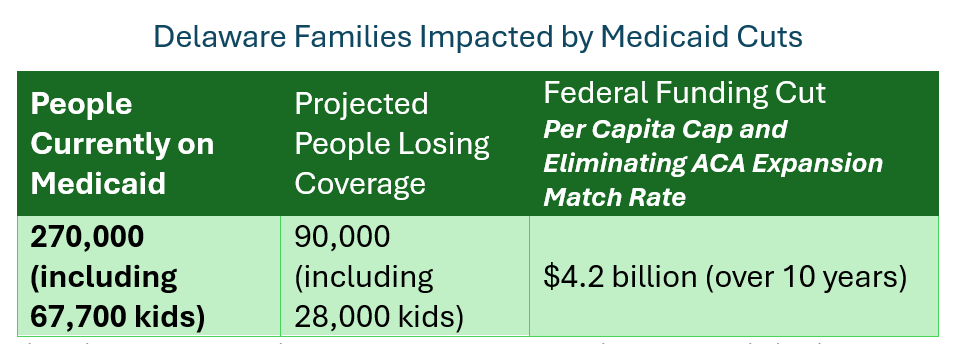

Medicaid Cuts could impact 90,000 Delawareans

Effective FY 2027–2028Medicaid plays a major role in schools across the U.S., providing $7.5 billion annually for health services such as speech therapy, physical therapy, dental and vision care, and support for students with disabilities.

HR 1 introduces work requirements and spending caps, similar to those discussed in the previous section related to SNAP, that could result in millions losing coverage nationwide, with profound impacts on the employees and owners of small businesses, women, and young children, among other groups.

The bill also eliminates the enhanced federal match rate for states that expanded Medicaid under the Affordable Care Act (ACA). This shift would dramatically increase the state’s share of the costs, potentially requiring Delaware to shoulder an additional $208 million annually.

Delaware could face hard choices—either fill in the resulting federal shortfalls or allow lapses in health coverage. These lapses would affect those covered by Medicaid, which in Delaware is one in four people, or three in eight children.

Note: This estimate reflects projected losses under a per capita cap and elimination of the ACA expansion match rate. It does not include potential impacts from new Medicaid work requirements or other provisions where state-level estimates are still unclear.

For more information on how Medicaid and SNAP cuts will affect young children, check out this one-pager from Children’s Funding Project.Categorical Eligibility Impacted by Medicaid and SNAP Cuts

Programs like Medicaid and SNAP don’t just provide direct benefits, they also serve as eligibility markers for other supports. In some schools, students enrolled in these programs are automatically eligible for services like free or reduced-price meals, summer electronic benefit transfer (EBT), and other supplemental education programs, depending on local policy.

Afterschool Programs at Risk

Update as of July 28, 2025: The Trump Administration has released the FY 2025 21st CCLC funds. This decision restores funding to approximately 23 Delaware programs and 7,000 students. However, the delay created significant short-term uncertainty and planning challenges, and future funding decisions through the FY 2026 process remain unclear. Read more here.

Afterschool and summer learning faces several threats due to the withholding of FY 2025 21st Century Community Learning Center (21st CCLC) funds and potential structural changes in the FY 2026 budget.

Although the 21st CCLC funds were approved by Congress and signed into law, the federal government has delayed distribution, citing a “program review.” This impacts up to 23 Delaware programs and about 7,000 students, along with 10,000 sites and 1.4 million students nationally.

Meanwhile, decisions made during the FY2026 appropriations process could result in the funding of 21st CCLC as-is, or it could be replaced by a new block grant.

Workforce Pell

Effective July 1, 2026The newly authorized Workforce Pell Grant Program expands Pell Grant eligibility to students enrolled in shorter-term, high-quality workforce training programs—typically 150–600 clock hours over eight to 15 weeks.

These programs must be offered by accredited institutions and aligned to in-demand industry sectors defined by Perkins V or Workforce Innovation and Opportunity Act (WIOA).

For more details on other student loans and scholarships impacted by HR 1, check out the analysis by Holland & Knight.Over One Billion in Cuts to Mental Health and Civil Rights

Mental health cuts. Over $1 billion in federal cuts to school-based mental health programs are threatening student access to counselors, social workers, and crisis supports. This is concerning given known, widespread, and pervasive youth mental health challenges, and is particularly frightening for schools already struggling to meet the needs of students.

Civil rights complaints. The U.S. Department of Education has quietly implemented new internal protocols that have led to the mass dismissal of civil rights complaints, particularly those written off because they have been filed by the same individual. These concerning changes reduce oversight of discrimination in schools and make it harder for students to seek justice for violations.

Public Service Loan Forgiveness (PSLF). Proposed federal rule changes could exclude organizations, including those that serve immigrants or provide gender-affirming care, from PSLF eligibility. Taking away this promised loan relief will harm educators, social workers, and other public service professionals. Combined with new repayment enforcement and the rollback of aid programs like SAVE, many face higher costs.

What’s Next for Delaware?

Delaware has previously taken steps to fight back against select cuts. Specifically:

- Delaware joined a coalition of states suing the Trump Administration over its decision to impound FY2025 federal grant payments, including education and safety net funding. It successfully blocked attempts to hold back these dollars.

- Delaware was also part of a lawsuit challenging the “unauthorized disclosure of Americans’ private information and sensitive data.” This suit was successful in preventing further unauthorized access to federal financial systems.

Further lawsuits and the reorganization of funds at the state level are possible. However, it is likely that these cuts and changes will continue to have an impact on Delawareans, especially the most vulnerable. They will be a major consideration during the development of the FY2027 state budget, which will be underway soon, as state leaders weigh whether to fill these federal funding gaps directly or take other approaches to mitigate the harm.

In Conclusion

This blog post is a summary of insights compiled by policy organizations, news outlets, and government sources (linked throughout). Yet, it does not capture the full range of recent federal actions impacting children, families, and educators. Numerous Supreme Court decisions and administrative changes by and to U.S. Department of Education continue to unfold, alongside various Executive Orders.

As this administration advances sweeping policy shifts, the cumulative impact on public education and family supports remains both urgent and evolving. Going forward, the onus will be increasingly on our collective shoulders as a state to be equally bold in our response to the needs of Delaware’s children and the health of our communities. We welcome working alongside you to keep the First State moving forward.

Related Topics: Delaware education, delaware schools, Secretary of Education, US Department of Education